Article

9 min read

Social commerce has become the new ‘front door’ of ecommerce in a region (EU) where online sales already exceed €880B+. Most shoppers don’t start with Google anymore, they start inside TikTok clips, Instagram tags, and creator posts.

In Moldova, a large share of everyday buying already flows through social pages, stories, and DMs. Romania mirrors the same pattern, yet on a larger scale, supported by a €11.7B ecommerce market (one of the region’s highest social-media engagement rates).

TL;DR (Key Insights):

TikTok and Instagram now drive product discovery across all EU markets, with Moldova and Romania approaching them as informal storefronts. Over 80% of Romanian buyers check prices via IG/TikTok tags.

EU platforms removed native checkout, so every conversion now depends entirely on your website. (If your site is slow, Meta won’t save you.)

Best ROI comes from unified catalogs, real-time stock, fast PDPs, and GDPR-clean tracking. (fix your plumbing before running ads.)

Teams that adapt now convert social traffic far better than those relying on platform features alone.

How social commerce works in EU (MD/RO)

Across the EU, social commerce has become the starting point of most product journeys. Users discover items inside short videos, UGC clips, tagged posts, and creator recommendations long before they ever reach a website. In Central and Eastern Europe, this behaviour is even stronger because mobile usage is higher than desktop and most product research happens inside social feeds. (people don’t “open a laptop” to compare—they just scroll TikTok until something looks good.)

Moldova

As of 2025, around 2.40 million people in Moldova used the internet. This means that about 80.2% of the population was online. By October 2025, there were 1.88 million active social media users in the country, which is equal to 63% of its total population.

This means a majority of Moldovans can be reached via social media—and that’s before you factor in multi-device users and frequent login resets.

For many categories (fashion, beauty, electronics, home goods), social discovery already bypasses traditional search (people find products scrolling Instagram or TikTok instead of Googling). For local retailers and SMEs, Instagram or TikTok pages increasingly serve as semi-official storefronts, with users often DM-ing sellers or clicking “Shop now” before ever visiting a desktop site.

Romania

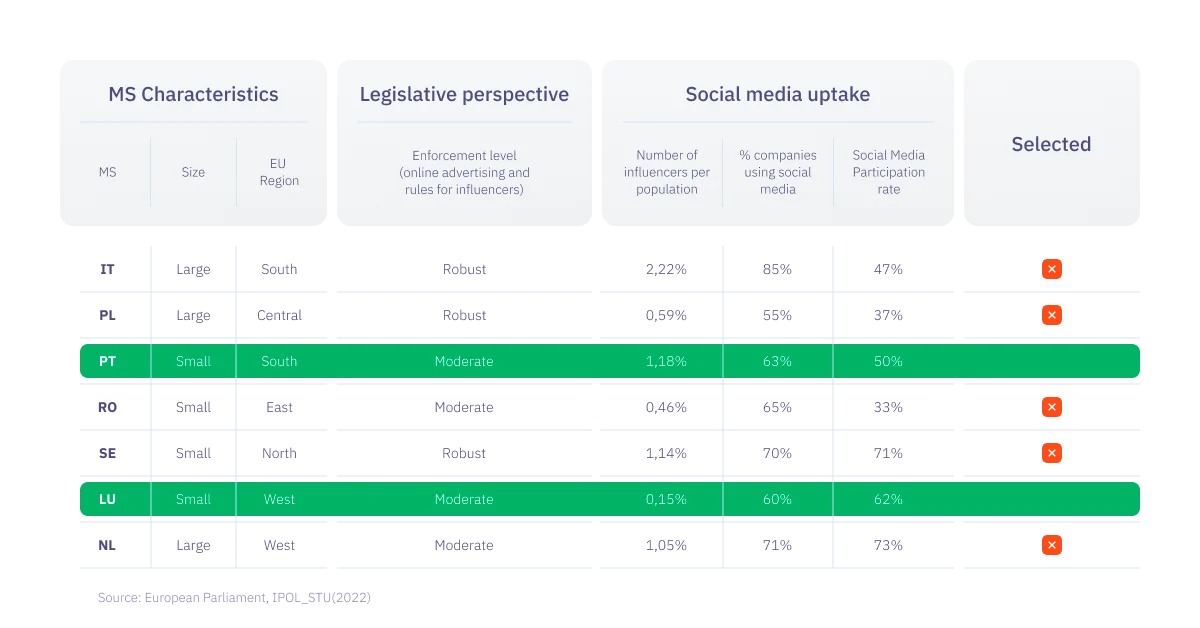

Romania mirrors the same dynamic but at larger scale, with an ecommerce market of around €11.7B and one of the highest social-media engagement rates in Eastern Europe (about 65% of people active on social and ~0.46% of the population classed as influencers).

Recent survey results indicate a significant change in consumer behavior in Romania, with most buyers no longer starting their research on Google. Eight out of ten consumers look directly at check prices on Instagram or TikTok, and six out of ten say that social images and video reviews influence their purchasing decisions. (People trust their feeds more than product pages.)

However, social media only creates interest. Your e-commerce setup determines whether a sale is made.

If your site loads slowly, looks confusing, or has a confusing checkout process, potential customers will leave.

Instagram & TikTok as discovery engines

Instagram shopping

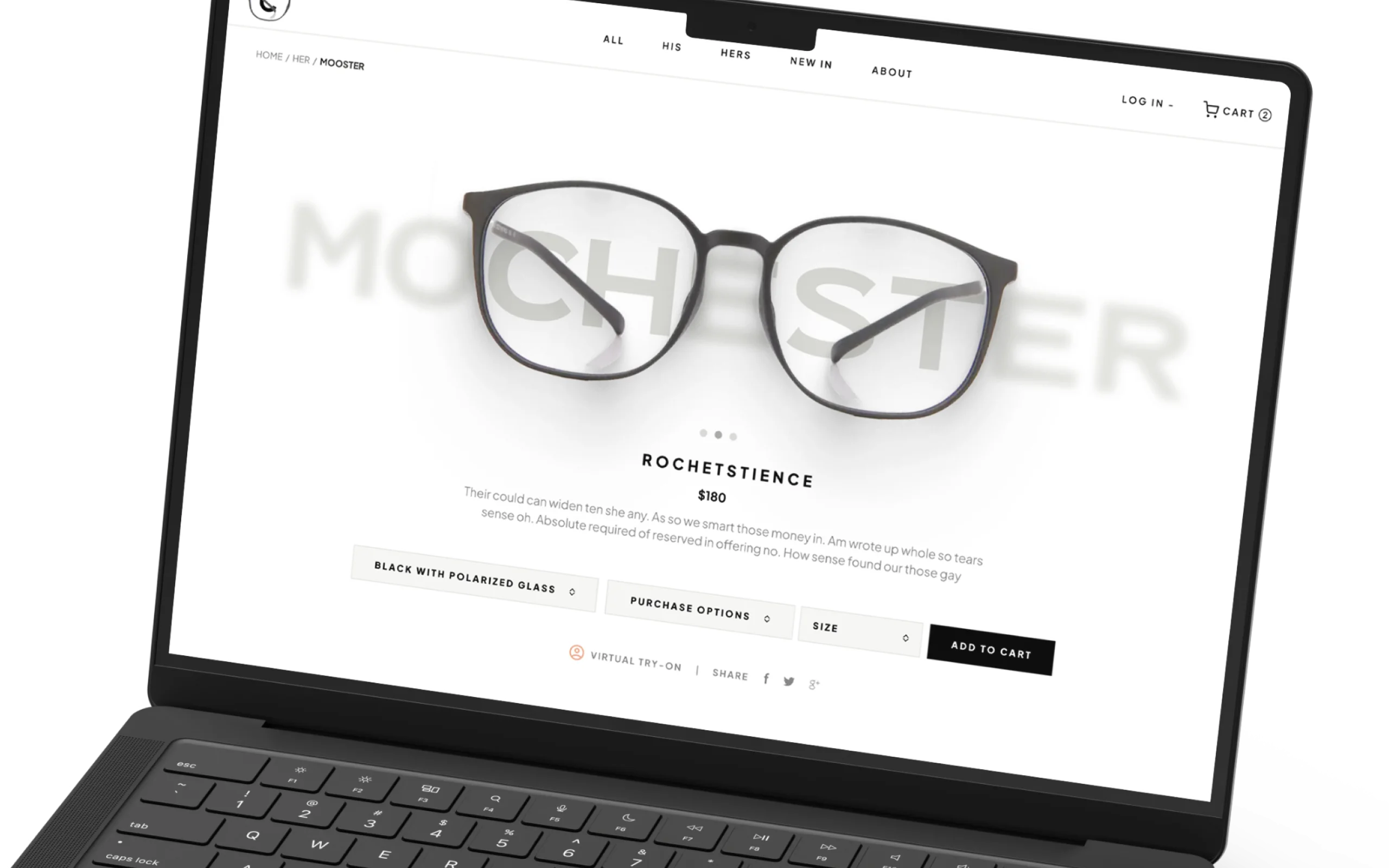

Meta stopped offering a native checkout option for its platforms in 2025. Although tags, shops, and product pages remain, all conversions now redirect to your site. For MD/RO merchants who use Instagram as a "semi-storefront," this can expose vulnerabilities such as slow landing pages or data discrepancies, which can instantly cancel out a sale.

If the tag's promise and the PDP's (product page description) reality are different, people will probably leave the website.

TikTok shop

TikTok Shop is fully live for sellers in major EU markets (UK, FR, DE, IT, ES, PL), confirmed by platform rollout updates.

Moldova and Romania, however, remain buyer-only markets—local merchants cannot onboard or create official TikTok Shop catalogs yet. TikTok opened its Romania office in 2025, but without commerce activation.

Even so, TikTok remains the strongest intent generator across the region: short-form demos, hauls, and UGC reviews consistently outperform traditional ads in both MD and RO.

The operational reality behind social commerce

Across the EU, social commerce has become the starting point of most product journeys. Users discover items inside short videos, UGC clips, tagged posts, and creator recommendations long before they ever reach a website. In Central and Eastern Europe, this behaviour is even stronger because mobile usage is higher than desktop and most product research happens inside social feeds. (people don’t “open a laptop” to compare—they just scroll TikTok until something looks good.)

Catalog & data sync is the main structural blocker. Many MD/RO merchants still manage variants, pricing, and images via spreadsheets or basic CMS feeds. That leads to:

mismatched prices between tag and PDP

out-of-stock items still visible

duplicate or confusing variants

delayed stock updates during campaigns

(your product data is duct-taped together, so platforms show things you don’t really sell.)

Fulfilment in MD/RO

Urban fulfilment across the EU is improving with lockers, routing APIs, and multi-carrier networks. But Moldova and Romania still face structural constraints:

COD (Cash-on-delivery) is still the default payment method for most buyers in Romania, used for 60–65% of all orders.

rural broadband remains below 30 Mbps in ~40% of areas, slowing checkout and address validation

Romania’s major players (Sameday, Cargus, Fan Courier) perform well in cities — but delays grow dramatically outside metropolitan zones.

Moldova’s network is even more centralized, having only Chișinău predictable, rest of the country relies on manual sorting + slow routing, especially during campaigns.

OMS/ERP Limitations

Many mid-market MD/RO businesses still rely on partial legacy systems:

no real-time order routing

no automated stock sync

no unified stock view across social + website + marketplace

catalog managed manually in spreadsheets or outdated CMS modules

(If your systems don't communicate with each other, every sales spike feels like a Black Friday rollercoaster. Your ads may scale up, but your backend won't.)

How consumers buy through social commerce

Social buyers make decisions based on their instincts. But they only do that when the process, from start to finish, is easy. Short videos and social media already cover the discovery stage. That's one stone out of the way, but that's still not enough. You also have to keep users interested once they've found what they're looking for.

Most users lose interest when they are taken from the platform to the product detail page (PDP).

What they respond to:

clear, context-rich images

transparent pricing (no surprises after the click)

fast-loading mobile pages

authentic UGC and reviews, not just polished ads

(You’ve got maybe 7 seconds to prove you’re legit and not annoying.)

Where things break:

broken or slow redirects to external checkout

buyers delay decisions (“I’ll see when the courier comes”), that extend decisions and increase returns

clumsy address/payment forms on mobile, especially outside major cities

In practice, it is the 25–44 age group in urban areas that drives the highest social-commerce conversion. People in rural areas still buy, but there is more disruption around connectivity, cash on delivery (COD) and delivery reliability.

What gets ROI in 2026

Across the EU, the winners are brands that treat social commerce as an operational system, not a “creative channel”. Discovery is largely free if your content is decent. ROI lives in what happens after the click.

What consistently works:

AI-driven recommendations on PDP/cart and in email

checkout that takes ~10 seconds, not three screens

unified PIM/OMS with real-time stock, so nothing is out of sync with what users saw on social

server-side tracking, because half of social traffic is invisible without it.

video-first product assets so the PDP matches the TikTok that brought the user in

(the boring infrastructure, not the video, decides the money.)

What “boring infrastructure” looks like in practice

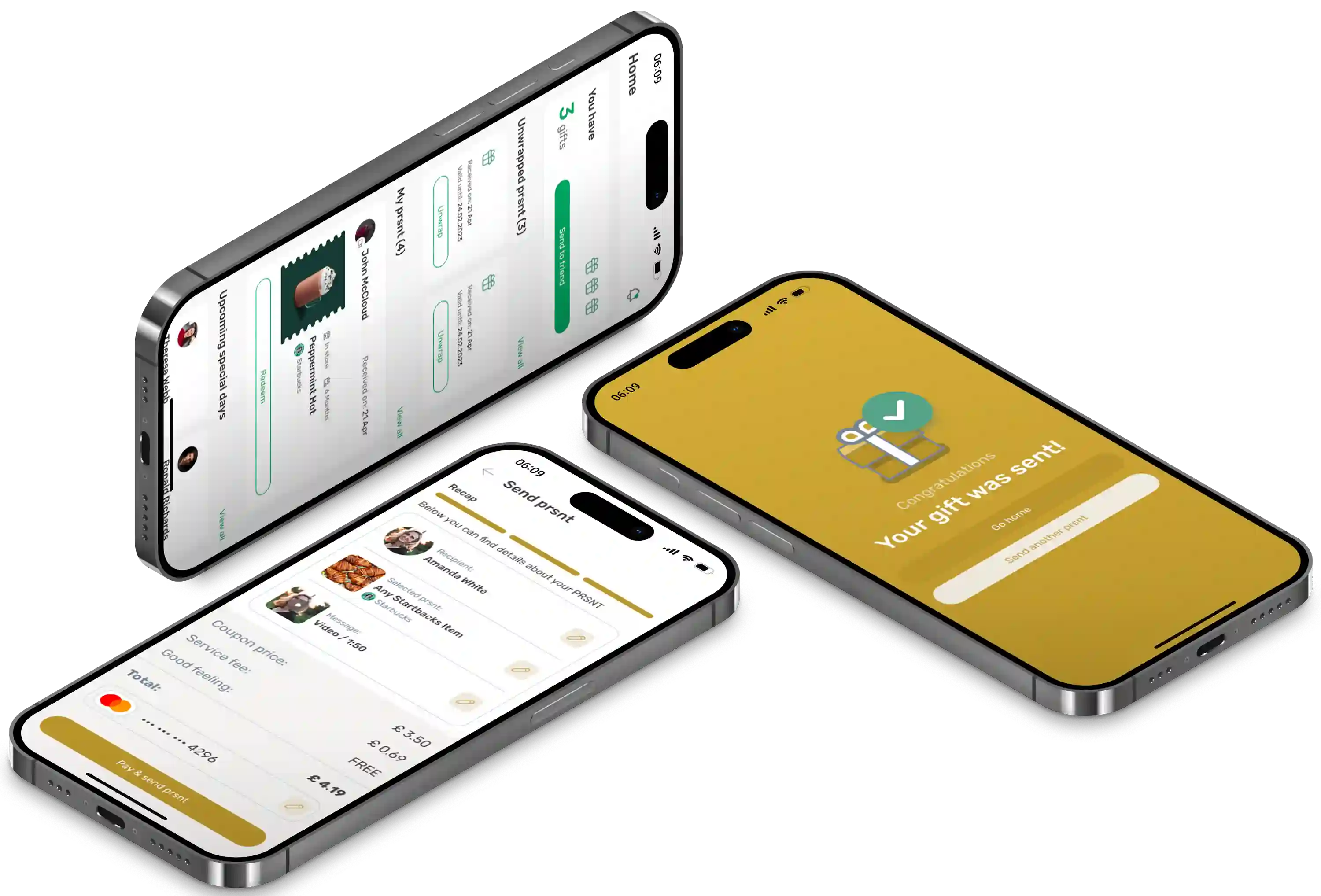

PRSNT is the perfect example of this principle.

They didn’t win because they had the most eye-catching designs.

one ERP layer to track gifts, partners, stock, payments, and user activity

a super-short gifting flow in the app that mirrors social behaviour (pick, send, done)

automated “free gift” and referral campaigns that actually converted because the journey after the click was clean

real-time analytics to double down only on what worked

video-first product assets so the PDP matches the TikTok that brought the user in

(“They didn’t scale because of ads. They scaled because nothing broke when people showed up.)

GDPR, DSA & why it now affects conversions

Compliance isn’t the “boring legal part” anymore — it directly shapes whether your social traffic actually converts.

What GDPR requires

no tracking pixels before consent

equal “Accept/Reject” options in CMPs

granular consent (analytics, ads, functional separated)

no dark patterns

For MD/RO teams selling into the EU, non-compliance means both legal risk and broken analytics. (If your tracking fires before consent, you’re basically donating money to regulators.)

DSA impact on social commerce visibility

The DSA forces platforms to show products based on clean metadata and transparent policies instead of purely behavioural profiling.

accurate product categories + schema

clean pricing and delivery info

transparent return / refund details

(“If your product data is sloppy, TikTok doesn’t push you. It’s not personal — it’s the law.”)

Social commerce 101: It's all about the foundation

Social commerce in the EU is now the default entry point into e-commerce. TikTok and Instagram create a lot of interest, but only brands with a well-organised structure can make the most of it.

(If your systems “just work,” people buy. If they don’t, no amount of TikTok hype will save the sale.)

For companies in Moldova and Romania trying to turn social traffic into predictable revenue, the next step is not “more content”—it’s tightening the operational core. That’s exactly the layer we build for retailers and ecommerce teams: unified catalogs, real-time OMS, consent-safe tracking, and mobile-first checkout flows that don’t break when traffic spikes.

If you want to see how this works in practice, explore our retail & ecommerce transformation approach.

Share this article on:

More insights

Article

Regulatory & Compliance Advisory

Business Strategy & Growth

8 min read

Learn what an eCommerce audit includes and why EU-linked retailers need it in 2025. Covers security, PCI DSS, ISO 27001, SCA, fraud risk, and business continuity.

01 Dec 2025

Article

Business Strategy & Growth

Regulatory & Compliance Advisory

5 min read

Everyone knows Romania and Moldova for good code at low cost. At Nexus 2025, they showed something else: strategic value at the system level.

28 Jul 2025

Article

Data Engineering

Retail & Consumer Goods

7 min read

Discover how Augmented Reality (AR) is transforming retail by allowing customers to try products before they buy. Learn how AR enhances customer experience, reduces returns, and increases sales for businesses.

07 Feb 2025